20th Anniversary Episode: Getting to Know the Founding Partners

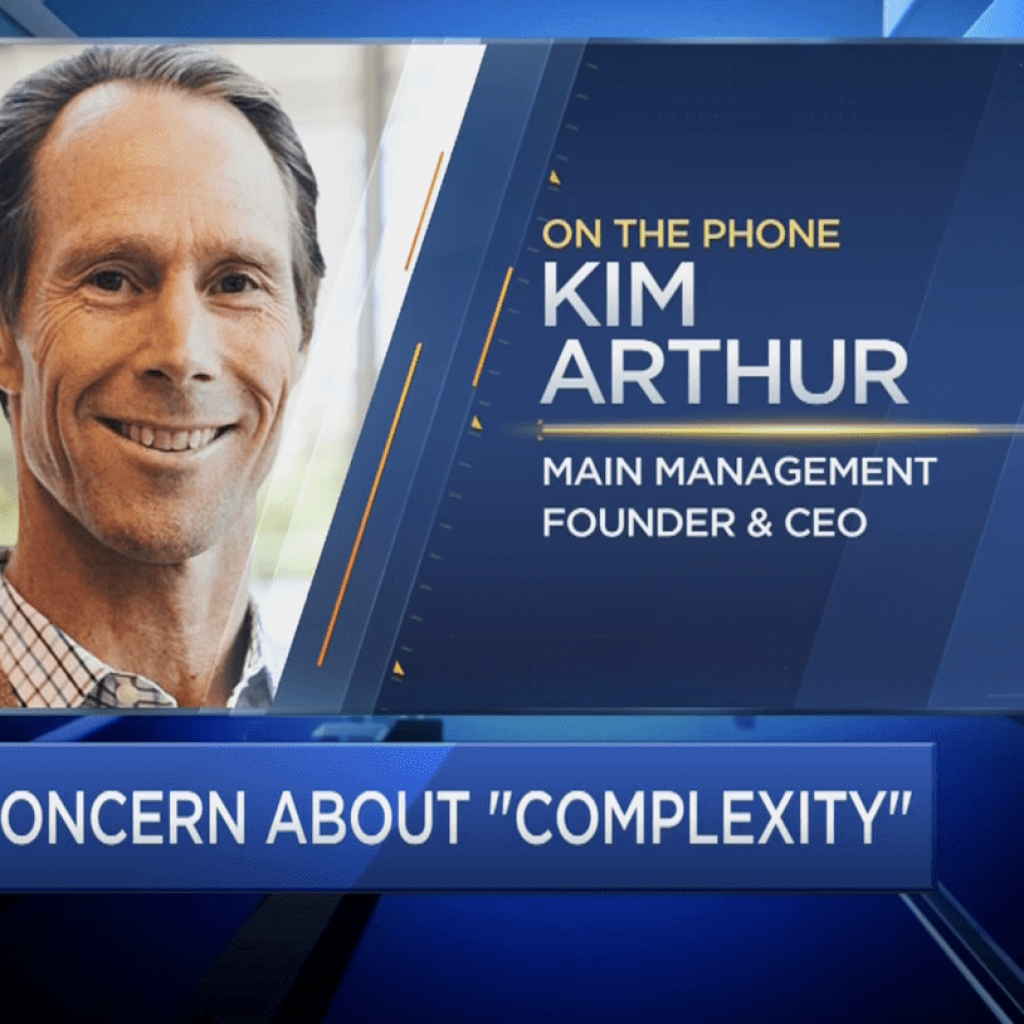

We sat down with our founding partners Kim Arthur, James Concidine, and Ambassador J. Richard Fredericks following our 2022 conference to learn about the genesis of Main Management, how the three began working together, what it was like to enter the ETF space, and more…

20th Anniversary Episode: Getting to Know the Founding Partners Read More »